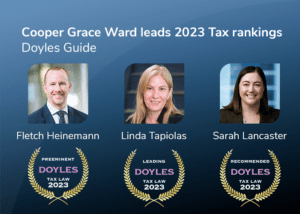

Leading Tax Lawyers at Cooper Grace Ward listed in Doyles Guide

Doyles Guide have released their latest Leading Tax Lawyers and Law Firms rankings, and Cooper Grace Ward are thrilled with the team’s performance.

Doyles Guide have released their latest Leading Tax Lawyers and Law Firms rankings, and Cooper Grace Ward are thrilled with the team’s performance.

These awards highlight lawyers and law firms excelling in tax advice and tax disputes matters within the Queensland legal market, as identified by clients and peers.

In this edition of ‘It depends’, lawyer Jack Colley talks about what you should do if the ATO is suing you.

Doyles Guide has released the 2023 rankings of tax law firms and lawyers in Queensland, and Cooper Grace Ward again leads the market.

Click below for who, what, where with lawyer Charlotte Boothroyd. Hear how long she’s been at Cooper Grace Ward Lawyers, what she would be doing if she wasn’t working in law and what she loves about her job.

In this episode of TaxLand, Fletch and Sarah take a ride through the NSW Supreme Court’s decision in Uber Australia Pty Ltd v Chief Commissioner of State Revenue. Accept our request to take a trip through the relevant contract provisions, exemptions and whether or not amounts are paid or payable in relation to the performance of work. Travel to TaxLand with us to learn more and leave us a five-star rating.

In this episode of TaxLand, Fletch and Sarah journey through the ATO’s new draft tax determination and PCG in relation to whether amounts of trust capital distributed to Australian resident beneficiaries are subject to section 99B.

In this episode Fletch Heinemann and Sarah Lancaster talk about the Grinch of Christmas – when section 99B applies to tax distributions of capital from foreign trusts. Travel to TaxLand with us to learn more!

In this episode of TaxLand with Fletch and Sarah, tax law partners Fletch Heinemann and Sarah Lancaster talk about the current state of play with the residency rules for individuals, including the current rules and the proposed new ‘modernised’ and ‘adhesive’ rules. Essential listening for Aussie expats and prospective expats!

Welcome to TaxLand with Fletch and Sarah. In their first podcast endeavour, Cooper Grace Ward tax law partners Fletch Heinemann and Sarah Lancaster talk all things topical in tax.

In this week’s edition of ‘It depends’, partner Fletch Heinemann talks about the proposed changes to tax residency rules for individuals.

Eagle-eyed observers may have seen the Government’s budget night promise to replace the current individual tax residency rules with a ‘new, modernised framework’.