Authored by: Rocco Russo, Max Carlyon and Michael Fielding

The recent Queensland Supreme Court decision in Peros v Nationwide News Pty Ltd (No 3) demonstrates that even the gravest of accusations may not meet the threshold of serious harm ...

Update: Land Tax Changes Have Been Scrapped The planned changes to the Queensland land tax regime highlighted in the article below have been scrapped by the Queensland Premier in an ...

The recent Queensland Supreme Court decision in Peros v Nationwide News Pty Ltd (No 3) demonstrates that even the gravest of accusations may not meet the threshold of serious harm under defamation law.

These awards recognise outstanding talent and contributions within the Australian legal industry.

Doyles Guide has released rankings for the top property lawyers and law firms in Queensland for 2024, and Cooper Grace Ward has performed exceptionally well once again.

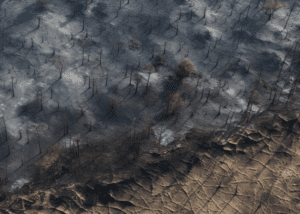

A bushfire management plan may be viewed as optional for many landholders, but neglecting your fire management obligations may put you and your business at significant risk. Discover the crucial reasons why the implementation and adherence to a bushfire management plan are important to safeguard you and your business.

The global demand for hydrogen is expected to nearly double between 2021 and 2030. According to the International Energy Agency’s 2022 World Energy Outlook, Australia is expected to become the second largest net-exporter of low emissions hydrogen by 2030 and the largest by 2050.

This article serves as a progress update on the Bill, with a refresher on its purposes and a summary of feedback from the consultation process.

Cooper Grace Ward’s dispute resolution group recently assisted a commercial property owner in the successful defence of Supreme Court proceedings about an obsolete easement.

In a change to Queensland waste legislation that will have ramifications for the development industry, disposing of ‘clean earth’ at a landfill facility from 1 July 2023 will incur payment of the waste levy at the general rate per tonne.

In this edition of ‘It depends’, senior associate Tom Walrut talks about the recent announcements concerning land tax changes in Queensland. Are the changes happening, what are the takeaways from all this and what should your planning considerations be going forward?

Queensland’s land tax changes are so significant that we are going to cover them in two ‘It depends’ videos. In part one, senior associate Tom Walrut covers what the changes are and how they will affect current landholders.

Update: Land Tax Changes Have Been Scrapped The planned changes to the Queensland land tax regime highlighted in the article below have been scrapped by the Queensland Premier in an announcement made on 30 September 2022. We will provide further updates as they become available. Queensland’s land tax hike is

A development approval is a significant step on the path to developing land. However, it is a mistake to assume further regulatory requirements are mere formalities. Increasingly, additional assessments and legal obligations are impacting land use including whether, when, and in what form, development can proceed.

Cooper Grace Ward acknowledges and pays respect to the past, present and future Traditional Custodians and Elders of this nation and the continuation of cultural, spiritual and educational practices of Aboriginal and Torres Strait Islander peoples.

Fast, accurate and flexible entities including companies, self-managed superannuation funds and trusts.