Not necessarily.

It is a common misconception that assets owned by a discretionary trust will not be included in the property available for division between spouses.

Separated spouses frequently argue about whether a trust forms part of the property pool, is a financial resource, or has no impact on their property settlement.

Whether a trust will form part of the property pool will depend on the nature of a spouse’s interest and their degree of control over the trust.

For a trust to be considered property, it is generally not enough for a spouse to simply be in a class of beneficiaries eligible for distribution from a trust.

When determining whether a spouse has control over a trust, the court will have regard to several factors, such as:

- the terms of the trust deed

- who is the trustee and appointer

- if the trustee or appointer is not a spouse, the degree of influence a spouse has over them

- who are the beneficiaries

- the history of trust distributions

- how the assets of the trust were acquired

- contributions by spouses to the property owned by the trust

- what benefits the spouses derive from the trust such as loans, motor vehicles, payment of expenses, etc.

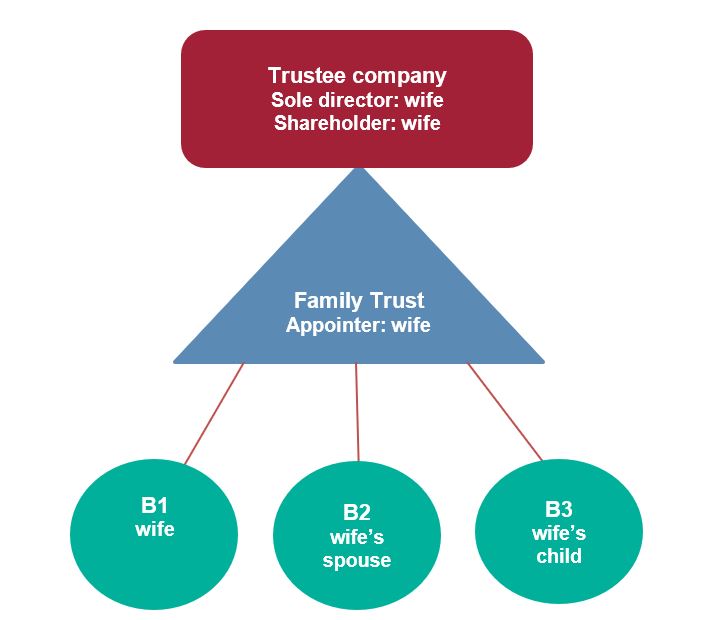

A common trust structure can look like this:

Assuming there are no unusual circumstances, the trust will be treated as property of the parties and be included in the property pool because the wife controls the trust through her roles as appointer and director of the corporate trustee.

An example at the other end of the spectrum would be a trust set up by a spouse’s parents, where the parents built up the assets in the trust, are the appointers and trustees, and the spouse is simply in a class of beneficiaries. In those circumstances, depending on the history of distributions to the spouse, the trust will most likely to be treated as a financial resource, and not included as an asset in the property pool because the spouse has no control over the trust.

Of course, each case will depend upon its own circumstances.

If you are setting up a trust for the purpose of wealth protection from your spouse, we recommend that you first see a family lawyer about whether your intention can actually be met with a trust structure and obtain advice about whether a financial agreement would better suit your needs. Information about financial agreements can be found at this link.