It is often difficult for employers to implement new employment contracts for existing employees, particularly when employers are seeking to make changes that are for the benefit of the business. ...

It is often difficult for employers to implement new employment contracts for existing employees, particularly when employers are seeking to make changes that are for the benefit of the business.

A person may be a tax resident of Australia even if they are not residing in Australia. This includes where the person’s domicile is in Australia, and they do not have a ‘permanent place of abode’ outside Australia.

All Queenslanders have an obligation to manage biosecurity risks under the Biosecurity Act 2014 (Act).

In Daniel Racek v DP World Sydney [2019] FWC 772, an employer was severely criticised by the Commission for allowing an employee to return to work after an incident in which the employee needed to be ‘talked down’ after threatening to commit suicide at work.

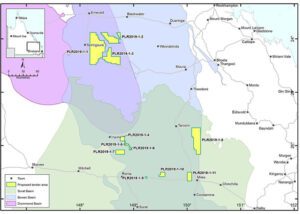

South Australia’s Minister for Energy and Mining, the Hon. Dan van Holst Pellekaan, last week (27 May 2019) announced that bidding is now open for a total of eight new Petroleum Exploration Licences (PELs) in the Cooper and Otway Basins.

Well, it depends. There are four tests for whether an individual is a tax resident of Australia under Australia’s domestic tax law.

At a state level, owners and users of all land in Queensland have a General Biosecurity Obligation (GBO) under the Biosecurity Act 2014 (Qld).

Coinciding with the 2019 APPEA Conference, the Queensland Department of Natural Resources, Mines and Energy has announced the release of 11 areas, totalling 3,742 square kilometres, now open to competitive non-cash tenders for petroleum and gas exploration in the Surat, Bowen and Drummond basins.

Determining whether a company is a tax resident of Australia has become more complicated… again.

The Fair Work Ombudsman’s recent focus on accessorial liability has again been demonstrated in a recent case where two directors who were ‘wilfully blind’ to the fact that employees were not being paid their entitlements were found personally liable for the underpayments.

In the recent decision of Sarah Cruise v Baxter Cassidy Pty Ltd T/A Ray White Langwarrin [2019] FWC 1751, the Commission found that an employer’s failure to consult with an employee caused the dismissal to be unfair and not a genuine redundancy.

On 27 February 2019, the Full Bench of the Fair Work Commission handed down an Annualised Wage Arrangements Decision that proposes additional record keeping and reconciliation requirements for employers.

Cooper Grace Ward acknowledges and pays respect to the past, present and future Traditional Custodians and Elders of this nation and the continuation of cultural, spiritual and educational practices of Aboriginal and Torres Strait Islander peoples.

Fast, accurate and flexible entities including companies, self-managed superannuation funds and trusts.