One of the most serious breaches of workplace health and safety laws involves reckless conduct.

Witnessing traumatic events at work can have devastating and long-lasting effects on employees.

Employers have managed employees for many years relying on the employee records exemption contained in the Privacy Act. However, in the recent case of Lee v Superior Wood [2019] FWCFB 2946, the Full Bench of the Fair Work Commission (FWC) turned the common understanding of the employee records exemption on

Importers risk misclassifying goods if they only use the text and context of the Customs Tariff Act 1995 (Cth).

An inheritance is not a protected asset in family law property settlements. Recent authorities reflect that, depending when an inheritance is received, the Federal Circuit and Family Court exercise wide discretion about how it is treated.

An inheritance is not a protected asset in family law property settlements. Recent authorities reflect that, depending when an inheritance is received, the family law courts exercise wide discretion about how it is treated.

The Australian Securities and Investments Commission (ASIC) has issued a legislative instrument confirming it will not be mandatory for smaller not-for-profits and charities to implement a whistleblower policy in connection with Australia’s new whistleblower protection regime that came into effect on 1 July 2019.

The Full Federal Court decision in Harding clarified two of the four tests for when an individual is a tax resident of Australia.

In what has become a fairly infamous episode in family law, an American woman was charged after tasering her husband repeatedly when he told her he wanted a divorce. ‘Shock and distress’ fail to adequately capture her response to the announcement. Read our brief and basic guide about what to

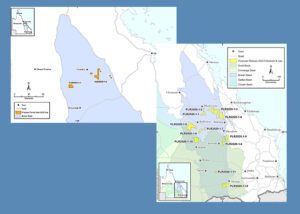

The Queensland Government has released more than 7,000 km² of land for petroleum and gas and coal exploration.

After a lengthy Modern Award review period resulting in numerous changes to the Modern Awards, the first changes were implemented on 4 February 2020.

We often see clients who ask for a second opinion about their family law matter and seek advice regarding their options to appeal after a judge has made an unfavourable decision.

Cooper Grace Ward acknowledges and pays respect to the past, present and future Traditional Custodians and Elders of this nation and the continuation of cultural, spiritual and educational practices of Aboriginal and Torres Strait Islander peoples.

Fast, accurate and flexible entities including companies, self-managed superannuation funds and trusts.